![]()

![]()

![]()

Gold: Just In Case, It Is a Depression

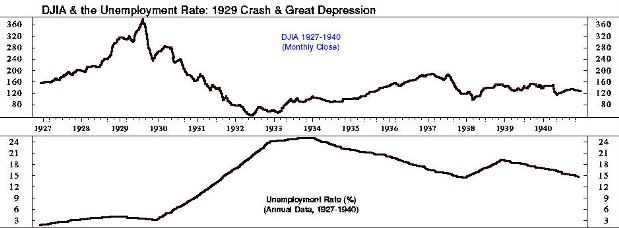

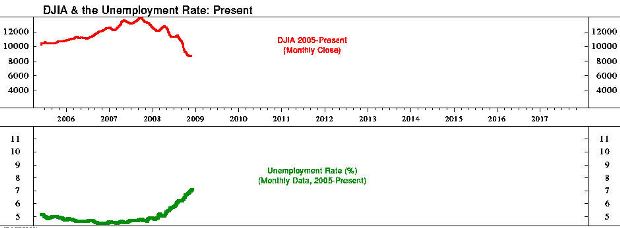

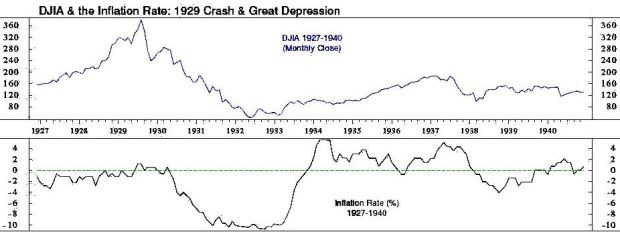

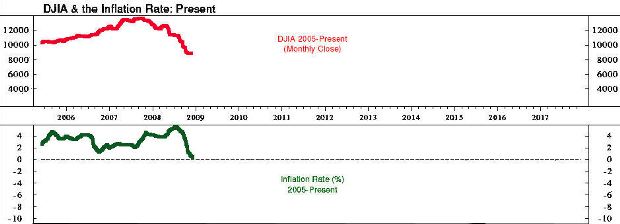

Just in case we are dealing with a depression, you may want to look at gold as a safe haven for your money. There is a noteworthy similarity between the position of the markets to-day and the position of the markets after the crash of 1929. The charts of the Dow Jones averages, when superimposed upon each other, show a scary resemblance; the same is true for inflation and unemployment. The chart published by Ned Davis Research (see below) is uncanny and clear at the same time.

Gold tends to protect investors when everything else goes bad. Just like in 1929-1932, when the only NYSE stock that rose in price was Homestake Mining, a gold company (in the meantime the Dow Jones Industrial Average lost 89% of its value, chart below).

Or during the secular bear market of 1968-1974, when the Dow dropped by 46% and the price of gold enjoyed a 360% jump.

If we mark the beginning of this secular bear market in stocks back in January 2000, the price of gold has moved from $280 per ounce to some $1,000 per ounce.

HOMESTAKE MINING

prices in US$

Source:Ned Davis Research